최신기사

KEISER Inc. Attracts Investment and Selects for TIPS

KEISER Inc. has attracted investment from C&Venture Partners (KVIC) and has been selected for TIPS R&D in the year of its establishment. C&Venture Partners is the investment firm that won VC of the Year (Small Business Category) at the KVIC Korea VC Awards last year. KEISER is a tech microbusiness founded this year in 2025, and has received awards in its first year, including "CES Innovation Award", "Grand Prize・Minister Award at Digital Innovation Contest of MCST", Commendation from Chairman of KBIZ, and Commendation from Commissioner of MOIP. The startup has also completed R&D project with the Korea Copyright Protection Agency (KCOPA). KEISER is participating in overseas exhibitions. This year, the company participated in the ICT EXPO Tokyo and the VIETNAM ICTCOMM Ho Chi Minh City. At the ICT EXPO, the company was selected as one of the 10 pitching companies, alongside AhnLab and Eastsoft. KEISER will participate in CES 2026 San Francisco in January next year. CEO of KEISER expressed gratitude for the investment and support from C&Venture Partners (KVIC). He stated, "With the secured funds, we will commercialize all the various technologies and features currently in development at the 'beta and alpha levels,' and move forward with the goal of becoming an innovative music platform." 정현식 기자IS investment investment firm korean companies venture partners

2025.12.25. 18:32

[Column] CTF: Redefining the Paradigm of Climate-Tech Investment

Capital deployment for climate action has entered a stage of maturity. While countless funds highlight ESG and impact investing, few combine structural innovation with executional strength as effectively as the Climate Technopreneurship Fund (CTF). Managed by NH Absolute Return Partners (NH ARP), the Singapore-based subsidiary of NH Investment & Securities, CTF is a US $200 million fund endorsed by the Green Climate Fund (GCF). It goes beyond traditional capital mobilization, representing an ambitious attempt to redefine the philosophy of climate finance. Upgrading Blended Finance: Smart Blending At the core of CTF lies a precisely engineered structure that combines public first-loss capital with private investment. The Green Climate Fund (GCF) contributes US $83.75 million, representing about 42% of the total fund, as a first-loss tranche to protect downside risks for private investors. This structure goes beyond a conventional subsidy — it is designed so that GCF also participates in returns linked to fund performance, aligning public and private interests with exceptional precision. Given the historical loss rates in climate-tech investing and the risk premiums in emerging Asian markets, this level of protection represents a strategic design that maximizes both private-sector participation and capital efficiency. Practicality of a Multi-Strategy Approach: Bridging the Scale-Up Funding Gap CTF adopts a multi-strategy model, combining debt, mezzanine, and equity investments to bridge the funding gap that typically arises after the grant phase but before project financing. Debt investments provide stable cash flow and anchor the fund’s base returns, equity captures long-term upside potential, and mezzanine financing seamlessly links the two, optimizing the portfolio’s risk–return profile. This finely balanced structure enables the fund to deliver risk-adjusted returns demanded by institutional investors while sustaining the growth trajectory of innovative climate-tech enterprises. Precision in Impact Measurement: Setting a New Benchmark CTF sets clear, quantifiable goals of reducing 1.64 million tons of CO₂ annually and reaching 2.3 million beneficiaries. Each investment’s projected impact is calculated through a bottom-up approach, following internationally recognized methodologies such as those of UNFCCC, CDM, and IFC, and is independently verified to ensure credibility. By incorporating the realities of climate-vulnerable communities and balancing fairness with effectiveness, CTF enhances the rigor and integrity of its impact governance framework, establishing a new benchmark for climate finance accountability. Regional Expansion Strategy: Integrated Localization Model One of the key reasons global funds often underperform in Asia is the lack of local understanding and mismatched partnerships. CTF addresses these challenges by combining NH Group’s network of 37 offices across 14 countries with GGGI’s channels in over 50 member states. This integration establishes a collaborative framework that goes beyond simple deal sourcing to encompass technical due diligence, policy coordination, and post-investment monitoring. From early pipeline formation to execution and exit, the fund’s localization strategy is systematically embedded throughout the entire investment process. 7 Investment Themes: Reflecting Regional Specificities CTF’s investment themes encompass renewable energy, energy storage, low-emission transportation, energy efficiency, agricultural technology, water resource management, and waste management. These priorities directly address Asia’s structural challenges such as agricultural dependence, water scarcity, and the surge in waste generation driven by urbanization. While some of these areas attract relatively less market attention, they play a strategic role in raising the threshold for systemic transformation across the region. Case Study: Localization as a Strategy for Climate Solutions One of NH ARP’s representative investment cases is a portfolio company “A” that develops, owns, and operates renewable power generation assets centered on solar and wind energy. Unlike Korea’s centralized electricity supply system dominated by KEPCO, many Southeast Asian countries operate decentralized markets where private companies generate power through their own facilities and sell directly to consumers via power purchase agreements. Within this structure, the company commercially operates a cumulative 1 GW of wind and solar power capacity, achieving approximately 1.5 million tons of annual CO₂ reduction while maintaining stable profitability and sustained financial growth. This case illustrates NH ARP’s approach as an investment manager that goes beyond financial execution, deeply understanding the institutional, technological, and economic structures of local markets and translating that insight into effective, locally grounded investment strategies. Implications for the Korean Financial Industry The success of CTF offers meaningful lessons for Korea’s financial sector. Above all, ESG and climate investment have shifted from being optional initiatives to essential elements of competitive advantage. In an era where traditional financial returns alone can no longer define sustainability, incorporating climate risks and impact metrics as core variables in portfolio management has become the new standard. Moreover, the Asian market provides Korean financial institutions with a distinct comparative edge. Compared to their Western counterparts, they possess a deeper understanding of Asia’s industrial structures, policy environments, and social contexts. Leveraging these regional strengths to build local partnerships and operational capabilities can unlock new avenues for growth. Finally, future differentiation will depend on the ability to move beyond capital intermediation — to coordinate diverse stakeholder interests, blend public and private capital, and design sustainable financial architectures. The capacity to structure complex relationships and manage both capital and impact simultaneously will define the next frontier of competitiveness for Korea’s financial industry. Future Challenges: Talent, Exit, and Policy For CTF to sustain its success, several key priorities must be addressed. First, there is an urgent need to nurture interdisciplinary talent that bridges climate technology and finance. Such professionals must go beyond conventional investment analysis to assess both the economic and environmental implications of technologies and engage effectively with global partners. Second, diversification of exit strategies is essential. Since IPO markets in many Asian countries remain underdeveloped, alternative exit routes such as mergers and acquisitions (M&A) or strategic investor buyouts should be pursued in parallel. This approach will enhance capital recycling efficiency and foster a sustainable reinvestment cycle. Finally, stronger policy alignment is critical. Shifts in national climate policies and regulatory frameworks directly affect investment returns; thus, sustained dialogue with policymakers and joint program initiatives are vital to ensure institutional stability. The ability to coordinate between public policy and private capital will determine the long-term sustainability of climate finance. Conclusion: Challenging the New Standard CTF represents more than a single fund; it is a pioneering attempt to redefine the standard for climate finance. Regardless of whether its quantified goals of 1.64 million tons of CO₂ reduction and impacting 2.3 million beneficiaries are fully achieved, its blended structure, multi-strategy approach, and rigorous impact management already mark a significant milestone. As this model expands beyond Asia to the global stage, Korea’s leadership at this turning point will be particularly meaningful. The climate crisis is both the greatest challenge and the greatest opportunity, and CTF stands as a leading example of how that opportunity can be turned into tangible impact. 정현식 기자Column redefining investment private investment climate finance green climate

2025.11.21. 0:01

Cardigan Mountain Student Wins Korea Financial Investment Association Youth Stock Pitch Competition with Crocs Investment Analysis

Leo Hwang from Cardigan Mountain School captured first place at the Korea Financial Investment Association (KFIA) Youth Stock Pitch Competition, delivering a comprehensive investment recommendation for footwear manufacturer Crocs Inc. to a distinguished panel of financial industry executives. The prestigious competition, hosted by Skywalk Asset Management, brought together talented young analysts to demonstrate their abilities in equity research and investment presentation. Participants were challenged to analyze publicly traded companies and present actionable investment recommendations following professional industry standards. Each team delivered detailed presentations followed by intensive question-and-answer sessions with judges. Hwang's winning presentation made a compelling "buy" case for Crocs stock, structured around several strategic themes. He emphasized the company's successful transformation from a niche foam clog manufacturer to a globally recognized lifestyle brand with broad market appeal. His analysis explored how Crocs has effectively segmented its customer base between "Feel Goods" - primarily suburban, family-oriented consumers - and "Explorers" - younger, urban customers focused on fashion and self-expression. A central component of Hwang's thesis focused on Crocs' innovative marketing strategies and brand evolution. He detailed how the company has leveraged social media campaigns and influencer partnerships to drive brand awareness, particularly highlighting viral marketing initiatives that have generated significant online engagement. The presentation examined Crocs' strategic collaborations with celebrities and fashion designers to elevate the brand's cultural relevance beyond its functional roots. The analysis also addressed Crocs' international expansion strategy, exploring how the company has adapted its marketing approach for different regional markets. Hwang discussed the company's efforts to penetrate emerging markets through culturally relevant campaigns and localized product offerings, demonstrating deep understanding of global consumer behavior patterns. On the product innovation front, Hwang examined how Jibbitz customization has transformed Crocs from simple footwear into a platform for personal expression, particularly resonating with Generation Z consumers who value individuality and creativity. He argued that this customization ecosystem creates additional revenue streams while strengthening customer engagement and brand loyalty. The presentation included comprehensive industry analysis, positioning Crocs within the broader footwear market and comparing its strategies against both direct competitors in the comfort footwear segment and traditional athletic brands. Hwang explored market trends including the casualization of fashion, the rise of comfort-focused products in post-pandemic consumer preferences, and the growing importance of sustainability in purchasing decisions. Financial analysis formed another crucial pillar of the presentation, with Hwang examining the company's revenue growth trajectory, margin expansion opportunities, and capital allocation strategies. He discussed the evolution of Crocs' distribution channels, particularly the growth of direct-to-consumer sales and e-commerce penetration, which have contributed to improved profitability metrics. Risk factors received thorough treatment in the presentation, including analysis of potential challenges from the company's acquisition strategy, particularly regarding the integration and performance of acquired brands. Hwang also addressed macroeconomic concerns such as trade policy implications for international operations and the potential for market saturation in mature geographic regions. Second place was awarded to Sam Im from Fort Worth Academy, who presented an investment thesis for Sony Corporation. Im's presentation examined Sony's diversified conglomerate structure, analyzing synergies across its gaming, entertainment, and technology divisions. He explored how PlayStation's market dominance provides a platform for content monetization, while the company's leadership in image sensor technology and strategic acquisitions in entertainment content create multiple growth vectors. His analysis highlighted Sony's transformation from a hardware-centric electronics manufacturer to an integrated entertainment and technology powerhouse. The competition format required participants to deliver their analysis within strict time constraints while maintaining professional presentation standards. Following each presentation, teams faced challenging questions from the industry executive panel, testing their depth of knowledge and ability to defend their investment theses under pressure. In their closing remarks, the judges commended all participants for their analytical rigor and presentation skills, noting that the quality of research demonstrated exceptional promise for the next generation of investment professionals. They emphasized that beyond technical analysis, successful investing requires the ability to craft compelling narratives that connect financial data with broader strategic themes - a skill clearly demonstrated by the winning presentations. The KFIA Youth Stock Pitch Competition serves as an important platform for developing young talent in Korea's financial sector, providing students with invaluable experience presenting to industry leaders while fostering analytical and communication skills essential for careers in investment management. 강동현 기자 [email protected] association investment recommendations investment presentation investment association

2025.11.11. 23:10

Crit Ventures USA Makes Strategic Investment in AI-Native Art Platform ‘Artue’

Crit Ventures USA, the U.S. subsidiary of Crit Ventures(CEO: Jaejoon Song), announced that it has made a strategic investment in Habitus Associates, the operator of the AI-native art platform “Artue” (CEO: Bo Young SONG). Following this investment, Crit Ventures USA becomes the second-largest shareholder of Habitus Associates based on the total value of its managed funds. Launched in 2023 with the vision of becoming the “Operating System (OS) of the Art Market in the AI Era,” Artue is an AI-native art platform that understands users’ aesthetic preferences and recommends artworks through conversational, multimodal, and emotion-based search. The platform currently features over 540 artists and 4,000 artworks, with both artist participation and artwork listings growing by 15% and 20% respectively over the past year — reflecting Artue’s rapidly expanding global reach and influence. Artue has filed the world’s first patent for an AI-based art recommendation and discovery system, recognized as a pioneering case of technological standardization in visualizing artistic experience. The innovation was showcased as a featured example at the OpenAI Korea Launch Event. In addition, Artue integrates blockchain-powered copyright protection, forgery verification, and digital ownership management, building a trusted global art transaction infrastructure. The company is now advancing initiatives for tokenized securities (STO) of physical artworks and the establishment of a global art investment fund. To support this, Artue has entered a technical partnership with CONX (ticker: XPLA) — an STO blockchain platform involving Com2uS Holdings — to develop a next-generation ArtTech financial infrastructure that unites AI, blockchain, and digital assets. A representative from Crit Ventures USA stated, “Artue is at the forefront of the digital transformation of the art industry, rapidly integrating cutting edge technologies into the creative economy. As the AI sector shifts from general-purpose models toward domain-specialized applications in content, design and entertainment, Artue stands out as a leading example of this evolution.” Bo Young SONG, CEO of Habitus Associates, added, “AI is redefining how people experience and engage with art. Together with Crit Ventures USA, we aim to establish the global standard user experience (UX) for technology-driven art markets and set a new benchmark for the digital art ecosystem where AI and art coexist.” Meanwhile, Crit Ventures USA has recently opened a Palo Alto office following its Los Angeles expansion, actively supporting Korean startups in their North American market entry and global network expansion. 강동현 기자 [email protected] ventures crit ventures art investment native art

2025.11.09. 18:05

[LNS INVESTMENT] 아메리칸시티 청라, 미주 첫 특별 공급…12일 분양 설명회

인천 청라국제신도시 내 핵심 주거형 오피스텔 '아메리칸시티 청라'가 미주 한인들을 대상으로 한 특별 공급에 나선다. 이를 위해 오는 12일(수) 오후 6시, 로스앤젤레스 옥스포드 호텔에서 분양 설명회를 개최한다. 이번 설명회는 즉시 입주가 가능한 국내 신규 주거 상품을 소개하는 자리로, 실거주 및 투자 수요를 동시에 고려하는 미주 한인들의 관심이 예상된다. 특히 미주 고객 대상 가구 옵션 무상 제공 혜택이 마련되어 있어 설명회 전부터 상담 문의가 이어지고 있다. 아메리칸시티 청라는 청라국제신도시에서 처음 선보이는 주거형 오피스텔로, 대림건설이 시공을 맡았다. 총 240실 규모로 71㎡ A.B.C 타입 각 80실로 구성되며, 전 실에 3룸.2욕실 구조와 4베이 혁신평면, 넓은 펜트리가 적용됐다. 단순 임대용 오피스텔이 아닌 실거주 중심의 평면 설계가 특징이다. 또한 오피스텔 형태로 공급돼 외국인 토지거래 허가 등 추가 규제 없이 계약이 가능해 해외 교민 및 교포도 접근성이 높다. 입지 가치 또한 주목된다. 단지는 지하철 7호선 연장 '시티타워역(2027년 개통 예정)'과 인접해 있으며, 제3연륙교 개통, 수도권 제2순환고속도로 및 경인고속도로 등 광역 교통망 확충이 계획되어 있다. 여기에 약 5만평 규모의 복합쇼핑몰 스타필드 청라(확정), 800병상 규모의 서울아산병원 의료복합단지(확정), 청라국제신도시의 랜드마크가 될 청라시티타워 등 대형 개발 계획이 집중되어 미래 가치 상승에 대한 기대도 크다. 청라의 명소인 청라호수공원과 커널웨이에 인접한 수변.공세권 주거 환경 역시 강점으로 꼽힌다. 이번 미주 지역 분양은 LNS INVESTMENT(미주총괄)와 OK TOWN US(한국총괄)가 공동으로 진행하고 있다. 분양 설명회 좌석이 한정되어 있어 사전 예약이 필요하다. 상담 및 예약은 분양총괄본부장 사이몬 리(Simon Lee, DRE #01306412)를 포함한 미주 현지 에이전트들을 통해 가능하다. ▶문의: (818)974-4989 ▶주소: 680 Wilshire Pl. #419, Los Angeles(LNS INVESTMENT) 745 S. Oxford Ave, Los Angeles(옥스포드 호텔)업계 investment

2025.11.02. 12:51

LNS INVESTMENT Realty…한·미 부동산 연결하는 신규 사무실 전격 오픈

미국과 한국을 잇는 부동산 전문기업 'LNS INVESTMENT Realty'가 LA 한인타운 심장부에 새 사무실을 오픈하며 본격적인 한인타운 시대를 열었다. LNS INVESTMENT Realty는 지난 10월 3일 신규 사무실 오픈 기념식을 가졌다. 이번 개소는 급변하는 한미 양국 부동산 시장에서 고객에게 보다 밀착된 맞춤형 서비스를 제공하기 위한 전략적 행보로 평가된다. 새 사무실은 한인타운 중심에 자리해 접근성이 뛰어나며, 미국 내 부동산 투자와 매매를 원하는 한인 고객들에게 한층 편리한 환경을 제공할 것으로 기대된다. 회사 측은 단순한 거래 중개를 넘어 "부동산은 건물이 아니라 삶과 꿈이 담긴 공간"이라는 철학을 바탕으로 고객 자산을 안전하고 투명하게 지키는 신뢰의 파트너가 되겠다고 밝혔다. 대표 사이먼 리(Simon Yi)는 캘리포니아 주정부 공인 부동산 면허(DRE #01306412)를 보유한 전문가로, 지난 수십 년간 주택.상가.사업체.건물 등 다양한 부동산 거래를 안전하게 이끌어 왔다. 특히 그는 고객 개개인의 필요와 목표를 분석해 최적화된 자산 관리와 투자 전략을 제시하는 것으로 정평이 나 있다. 그는 "한미 양국 부동산 시장은 서로 밀접하게 연관되어 있으며, 한인 고객들의 안정적 자산 증식과 글로벌 투자를 위해 더욱 세밀한 조율이 필요하다"며 "이번 한인타운 사무실 개소는 고객과 더욱 가까운 곳에서 함께 호흡하고, 실질적인 가치를 제공하기 위한 결정"이라고 강조했다. LNS INVESTMENT Realty는 이번 오픈을 계기로 ▶개인 주택 매매 ▶상업용 부동산 투자 ▶사업체 매입.양도 ▶건물 관리 ▶한미 간 부동산 연계 서비스 등 전방위 서비스를 강화할 방침이다. 또한, 미국 내에서 한국 부동산 시장에 관심 있는 고객, 한국에서 미국 부동산 투자에 나서는 교포들을 대상으로 하는 양방향 컨설팅 서비스도 본격적으로 확대할 예정이다. ▶문의: (818)974-4989 ▶주소: 680 Wilshire Place, #419, Los Angeles알뜰탑 investment realty investment realty

2025.10.05. 19:01

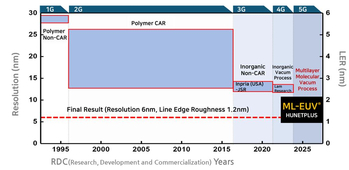

Hunet Plus Secures Investment from Global Strategic Investors…. Accelerates U.S. and Global Market Entry

Success in commercializing government sponsored next-generation technologies; expected to serve as a catalyst for building deep-tech investment ecosystem. Hunet Plus Co., Ltd. (CEO Hyukjin Cha), a company specializing in next-generation semiconductor and display materials, announced on Aug. 13th that it has secured Pre-Series B investment for entry into the U.S. market from global semiconductor-related companies, including strategic investors from Japan and Taiwan, as well as the Korean financial investor, ANDA Asia Ventures. In particular, this investment—secured at a time when US and Korea’s tariff issues in the semiconductor sector are coming to the forefront—marks a significant milestone, as it has attracted investment from leading investors from Korea, Japan, and Taiwan. The deal is expected to provide strong momentum not only for securing the original technology of ML-EUV® (Molecular Layer Assembled Extreme UltraViolet Technology, Process and Materials—a multilayer molecular film vacuum process-type photoresist for extreme ultraviolet lithography), but also for obtaining international patents to support market entry into the U.S., Japan and global markets. Furthermore, as one of the few Korean start-up companies to successfully attract foreign investment from Japan and Taiwan, Hunet Plus is expected to gain strong traction in expanding its markets while strengthening its global competitiveness. Hunet Plus’ ML-EUV® has overcome the limitations of achieving ultra-high resolution (below 10 nm line width) and sub-2 nm line edge roughness (LER), which have been difficult to realize with existing methods such as: ᄋ Second-generation chemical amplification resists (wet process, Chemical Amplification Resist) ᄋ Third-generation inorganic nano-cluster-based resists (wet process, Nano Cluster Based Resist) ᄋ Fourth-generation inorganic dry-process resists (dry process, Inorganic Precursor Resist) Hunet Plus’ ML-EUV® achieves world-class performance of ultra-high resolution below 10 nm and line edge roughness below 2 nm by using organic precursors and inorganic precursors at the molecular level, forming 10–20 nm ultra-thin multi-layered resist films through its proprietary Organic–Inorganic Molecular Layer Deposition Process®—an innovative dry molecular-layer stacking method. Through this strategic investment, Hunet Plus has formally launched commercialization efforts for ML-EUV®. Based on the world’s highest-performing ML-EUV®, the company plans to jointly commercialize ML-EUV® equipment and processes for dry processing with leading global semiconductor equipment manufacturers, while also supplying core organic and inorganic process materials for ML-EUV®-related semiconductor processes in partnership with global materials companies. In doing so, Hunet Plus aims to position itself as a key player in the semiconductor materials, components, and equipment sector. Hyukjin Cha, CEO of Hunet Plus, stated: “In the global semiconductor market, national borders no longer matter. In the near future, technologies and products like our ML-EUV®—innovative and market-leading—will be the basis for global companies to collaborate and build ecosystems that dominate the market and ensure sustainability. We anticipate additional USD 10 Million follow-on investments from our existing shareholders as well as other global companies, including in the U.S., and will work with local clients to build unique and sustainable ecosystem.” Haesun Kim, Senior Executive Director of HunetPlus, who played a pivotal role in leading the successful domestic and overseas fundraising, drew on more than 25 years of professional experience in international finance and foreign capital attraction, commented: “Although the past two years have been a very challenging period for Hunet Plus—requiring not only navigating detailed and rigorous due diligence imposed by top-tier international investors but also had to lead strategic negotiations—it has been deeply rewarding. In particular, despite a difficult investment climate as well as attracting interest from potential investors to one of the top level industries in the world, this has become a meaningful success story made possible by the organic cooperation with HunetPlus executives.” Cho Namhoon, CEO of K-Ground Ventures, an existing investor and the operator of Scale-Up TIPS who provided behind-the-scenes support for this investment, said: “Even in Korea’s challenging environment for bold investments in original technology, we had a strong belief in Hunet Plus’ global-standard R&D capabilities. Through the Hongneung Advanced Science & Technology Commercialization Fund, we took the bold step of making an early-stage investment, followed by support for subsequent fundraising, reinvestment through the Innovation IP Fund, and additional backing via Scale-Up TIPS. This long-term investment strategy has brought significant results. In particular, the attracting investment from renowned global investors is expected to support U.S. market entry and lead to further follow-on investments, ultimately building a sustainable global supply ecosystem for Korean semiconductor technology through joint Korea–U.S. R&D, production, and marketing.” Meanwhile, on August 6 (local time), U.S. President Donald Trump, at an Apple facility investment announcement event, stated, “We will impose 100% tariffs on every semiconductor imported into the United States.”This announcement has drawn intense attention from semiconductor startups and investors, as semiconductors are the second-largest category of U.S.-bound exports, especially ahead of the upcoming Korea–U.S. summit, where the government’s response will be closely watched. 정현식 기자investment investors leading investors tech investment support market

2025.08.13. 21:00

Era of 100 Trillion KRW in AI Investment: Korea Builds Investment Ecosystem for World-Class Physical AI Startups

As the era of 100 trillion KRW in AI investment begins, an investment ecosystem is being built in Korea for world-class domestic startups leading the Physical AI market. KGround Ventures, a deep-tech commercialization-focused venture capital firm and operator of the Scale-Up TIPS program, announced on the 8th of July that it has established the “K-Physical AI · AI Convergence Startup Alliance” in collaboration with domestic and international venture capital firms, local governments, and major associations. The goal is to create an investment ecosystem supporting the global expansion of AI convergence and on-device AI startups. Mr. Cho, CEO of KGround Ventures and organizer of the AI Council, stated: “From the perspective of technological sovereignty, we need sovereign AI. But in order to protect our technological sovereignty and generate real results in the global market, we urgently need a strategy to build value chains through the convergence of deep tech companies—based on Korea's core industries—and AI.” He emphasized that “This will enable mutual validation of technologies and the creation of viable markets.” He further added, “Deep tech companies with excellent technology and intellectual property (IP) should not be overly reliant on POCs (Proof of Concept) with large corporations. Instead, it is important that they commercialize converged AI technologies and IP applicable across industries within ecosystems developed in collaboration with support agencies and investors.” Cho concluded that “Korea already leads the world in technology competitiveness in deep tech fields such as semiconductors, manufacturing, defense, bio, and medical. Based on these strengths, we must build an AI convergence startup investment ecosystem centered on support agencies and investors to maximize synergy with sovereign AI.” Meanwhile, the event held on Friday, July 4 at Changjo Agora featured participation from several next-generation AI technology startups, including HyperVisual AI Inc. (CEO Sam-Yoon Jung), which is developing a GPNPU for on-device AI; Daton Co., Ltd. (CEO Dong-Hyun Kim), which owns a proprietary RBM (Restricted Boltzmann Machine) neural network model and is developing native LLMs and data center AI Ops; THIRA Robotics Co., Ltd. (CEO Dong-Gyong Kim), a company developing autonomous logistics robots; and WIM Inc. (CEO Woo-Jin Jun), a provider of AI control solutions for physical AI. Also in attendance were companies achieving results in AI convergence businesses in the bio, healthcare, and mobility sectors, including Qgenetics Co., Ltd. (CEO Mun-Seog Chang), Nemesis Co., Ltd. (CEO Sung-Ho Wang), and Yellowknife Inc. (CEO Han-Sung Lee). Notably, THIRA Robotics, HyperVisual AI, and WIM signed an MOU for joint development of next-generation AI logistics robots. They agreed to collaborate on market-driven joint R&D, investment attraction, global IP filings, and marketing through rapid decision-making and feedback processes. In addition, the launch event for the alliance saw active participation from global experts in AI convergence industries, including: ᄋ Seok-Jin Yoon, former President of the Korea Institute of Science and Technology (KIST) ᄋ In-Suk Han, Head of the K-Bio Lab Hub Project Group ᄋ Jong-Yun Kim, Head of the Venture Growth Center at Incheon Technopark (Incheon TP) ᄋ Young-Chul Yoo, CEO of Kairos Ventures ᄋ Yoon-Chul Lim, CEO of Technovalue ᄋ Dr. Sang-Min Lee of SambaNova, a Silicon Valley-based AI semiconductor company ᄋ Chi-Won Han, CEO of IPS Patent Law Firm Together, they declared the launch of the “AI Alliance SHIFT”, aiming to create global outcomes in the AI convergence industry, including physical AI. Former KIST President Seok-Jin Yoon, In-Suk Han of the K-Bio Lab Hub, and Nam-Hoon Cho, CEO of K-Ground Ventures, were appointed as co-chairs of the alliance. With the goal of connecting to the Silicon Valley investment ecosystem, they pledged to establish a representative AI consortium for Korea. Separately, K-Ground Ventures plans to form a global AI IP fund to invest in AI convergence technologies and physical AI companies and intellectual property (IP). In collaboration with global investment firms such as Plug & Play, a renowned Silicon Valley accelerator with an extensive international investment network, they intend to actively build a global ecosystem to nurture AI convergence global enterprises spanning physical AI and bio-healthcare. 정현식 기자investment ecosystem investment ecosystem physical ai ai convergence

2025.07.08. 17:18

HyperVisual AI Secures Investment from K-Ground Ventures Innovation IP Fund for On-Device AI Vision Intelligence

HyperVisual AI, a startup developing on-device vision intelligence solutions that apply AI technology directly on edge devices without relying on cloud connectivity, announced on June 2nd that it has secured investment from K-Ground Ventures, a leading VC in deep tech commercialization in Korea and the first operator of the Scale-up TIPS program. Founded in 2023, HyperVisual AI is a semiconductor-based AI startup that is developing a General-Purpose Neural Processing Unit (GPNPU)—an AI processor operable on-device—as well as proprietary AI models and frameworks. Their GPNPU architecture, a hybrid structure combining general-purpose GPU computing (GPGPU) and Neural Processing Units (NPU) into a single core, enables efficient low-power AI computation. This technology is considered highly optimized for on-device environments. The company was recently selected for the Ministry of SMEs and Startups' “1000+ Super Gap Startups” program, drawing significant interest from fabless firms, VCs, and investors. CEO Samyun Jung of HyperVisual AI stated that “We are pleased to have our patent value highly recognized and to have secured investment from the K-Ground Innovation IP Fund, which specializes in deep tech IP investments. HyperVisual AI is actively conducting joint development projects with client companies in the on-device AI industry, where convergent technologies are the key to competitiveness. With our outstanding R&D capabilities and Korea’s deep tech infrastructure, we aim to grow into a global hybrid vision intelligence total solution provider through collaboration with clients and investors.” Nam-Hoon Cho, CEO of K-Ground Ventures and a leading expert in deep tech technology commercialization, said, “We have long recognized the GPNPU hybrid architecture technology of HyperVisual AI as an innovative IP and technology that can lead the future on-device market. Based on mentorship and business support, we decided to proceed with the investment. The target markets for on-device applications—mobile, consumer electronics, mobility, and robotics—are areas where Korean companies are particularly strong. We believe that competitive Korean firms can lead the global market through convergent technology. Bold government policy support is needed to establish a new ecosystem that will lead the global on-device AI market, which is expected to become a next-generation growth engine.” K-Ground Ventures also announced that, through this investment, it plans to build an on-device semiconductor alliance in collaboration with organizations like the Fabless Industry Association, and actively work to discover, invest in, and foster innovative companies. According to a Deloitte report, the on-device AI market is expected to grow rapidly at an annual rate of 27.95%, reaching USD 16.7 billion by 2031. Attachment 1: Introduction to HyperVisual AI Technology The GPNPU architecture currently under development is designed so that the GPU and NPU share memory, with each handling parallel and matrix operations, respectively. This approach resolves bottlenecks, memory access delays, and complex pipeline issues common in traditional heterogeneous computing architectures (CPU, DSP, NPU), significantly improving power efficiency. Moreover, GPNPU is designed to support not only Vision Transformers but also multimodal and cross-modal AI architectures on edge devices, showing strong potential for future scalability. Based on this technological foundation, the company plans to complete GPNPU IP design by 2025 and begin commercializing its semiconductor IP in 2026. The ultimate goal is to secure technological leadership in the on-device AI market with a total vision intelligence solution that integrates their proprietary processor and models. 최지원 기자intelligence investment device vision ground ventures device environments

2025.06.01. 21:56

MJ Tech Inc. and Abdulaziz Saud Abunayyan trd Co. (Saudi Arabia eco-friendly solution company) have confirmed a US$100 million investment with a new concept generator

MJ Tech Inc. (located at 94-1 Manwol-ro, Namdong-gu, Incheon), a company that manufactures and produces key components for inductors for electric and electronic products, announced on December 17 in Saudi Arabia that it had signed a contract to attract an investment of US$ 100 million (approximately 140 billion Korean won) from Abdulaziz Saud Abunayyan trd Co. which is Saudi Arabian eco-friendly solution company, with its newly developed new concept, new technology generator (MLG-1). After the MOU signed at the Korea-Saudi Arabia Business Forum on July 30, 2024, MJ Tech Inc. has now achieved great results, providing an opportunity to establish itself as a leader in the global renewable energy sector in the future. The new concept new technology generator (MLG-1) developed by MJ Tech Inc. is a generator with a new technology that has not yet been introduced to the world, which drastically reduces frictional force and even resolves the heat generation caused by it based on the magnetic levitation technology that rotates the generator without using bearings. One of the Southeast Asian countries have already confirmed the specifications of MJ Tech Inc.’s generators and have expressed their intention to purchase over 50,000 generators, and they are planning to distribute them first to countries with underdeveloped power environments and households around the world that need eco-friendly power. Furthermore, generators that can be used for industrial purposes are also in the initial development stages. This investment will be used to establish a local joint venture and R&D center with Saudi Arabian Abdulaziz Saud Abunayyan trd Co., and to produce next-generation products with improved and superior performance, said Choi Seon-gyu, CEO of MJ Tech Inc., and expressed his gratitude to the CEO of Abdulaziz Saud Abunayyan trd Co. for his interest in and investment in the technology developed by a Korean SME. This contract is a valuable step forward that shows that Korean SMEs can also succeed in overseas expansion if they have technology that is recognized overseas, and it is expected to serve as an example for Korean companies armed with competitive items and technology. 박원중 기자 ([email protected])investment generator technology generator saudi arabia new technology

2024.12.22. 17:11

Youngest Performer: Galaxy Corporation's CEO “Choi Yong-ho” signs MOU with Saudi Investment Ministry during President Yoon's economic mission

Waleed Alobidiy, CEO of METAMIND, Badr Albadr, Vice Minister of Saudi Investment, and Choi Yong-ho, CEO of Galaxy Corporation, signed an MOU at the Korea-Saudi Investment Forum held at the Riyadh Fairmont Hotel in Saudi Arabia on the 22nd. Galaxy Corporation, an AI metaverse company, participated as an economic delegation during Republic of South Korea's President Yoon Suk Yeol's state visit to Saudi Arabia and Qatar, which lasted for four nights and six days until the 26th. Galaxy Corporation signed an MOU at the Korea-Saudi Investment Forum on the 22nd (local time). The forum was organized by The Federation of Korean Industries(FKI) and the Saudi Investment Ministry. The MOU was signed by the Saudi Ministry of Investment and Galaxy Corporation with the aim of entering and expanding the sports business market in the MENA (Middle East and North Africa) region, with a particular focus on Saudi Arabia. Galaxy Corporation, South Korea's first AI metaverse company founded on a global super IP, has recently gained attention as the producer of Netflix's survival entertainment 'Physical: 100'. Prior to this, Galaxy Corporation produced 'Bookae Contest' on Mnet in 2020, 'The Era of Bookae' on TV Chosun in 2021, and 'AVA DREAM' in 2022. Galaxy Corporation has established a close relationship with Saudi Arabia. Now, the spotlight is on whether Galaxy Corporation will venture into the entertainment and sports industries, leveraging the success of Netflix's 'Physical 100'. Choi Yong-ho, the CEO of Galaxy Corporation, accompanied South Korea’s President Yoon on his state visit to Saudi Arabia and Qatar. The economic mission included most of the heads of major Korean conglomerates, such as Samsung Electronics Chairman Lee Jae-yong, Hyundai Motor Group Chairman Chung Eui-sun, Hanwha Vice Chairman Kim Dong-kwan, GS Chairman Huh Tae-soo, and HD Hyundai President Chung Ki-sun. Notably, Choi Yong-ho, born in 1989, drew attention as the youngest member of the delegation. Galaxy Corporation is the only entertainment company represented, apart from CJ ENM. Following 'COMEUP 2022' held in Seoul in November last year, Galaxy Corporation continued its exchanges with Saudi Arabia's Minister of Investment, Khalid al-Falih, and Minister of SMEs and Startups, Lee Young. During this event, they were among the first to visit. Later, in March at 'Bivan 2023' in Riyadh, Saudi Arabia, Galaxy Corporation signed a memorandum of understanding (MOU) with the Saudi Arabian Ministry of Investment to collaborate on entering the Middle East business. Further achievements can be expected as a result of the MOU signing ceremony, which was attended by approximately 50 government officials and businessmen from both countries and took place on the morning of the 22nd (local time). Jang Ho-Gi, the producer of 'Physical: 100,' who recently joined Galaxy Corporation, stated at the "BCWWW (Broadcast World Wide) 2023" event held in August, 'The vision is to create the series in different countries, starting in Korea, and develop it into an international sports event, similar to the Olympics, in the future.' It is expected that 'Physical: 100' will serve as a link and an investment bridge between Galaxy Corporation and the Saudi Arabian sports industry. Saudi Arabia continues to invest vast sums of money in the sports sector. In June, the U.S. PGA Tour and Saudi Arabia LIV Golf merged with approximately $3 billion. Additionally, Saudi Arabia has expressed its intention to host the FIFA World Cup for the second consecutive year, with plans to host the 2035 FIFA Women's World Cup just one year after the 2034 FIFA World Cup. Through 'Physical 100', Galaxy Corporation has showcased its technological prowess in broadcasting production, management, and the entertainment industry. This could potentially open doors for the company to enter other Middle East regions, particularly Saudi Arabia and Qatar, both of which have shown significant interest in the sports business. An entertainment industry source mentioned, 'Galaxy Corporation has already signed an MOU with Saudi Arabia in March, so it should be able to deliver concrete results during this state visit. If we establish business infrastructure in the Middle East, including Saudi Arabia, including core capabilities and technologies such as metaverse, artificial intelligence (AI), and virtual reality, significant growth could be achieved.’ 김진우 기자 ([email protected])corporations investment saudi investment galaxy corporation saudi ministry

2023.10.23. 17:53

Principal Bruce Jeong of Middle East Investment Facilitates Aiitone in Signing MOU with the UAE Royal Family.

The MOU between the UAE Royal Family and aiitone has been concluded, confirming the promotion of business between Korea and the UAE. KOSDAQ-listed company aiitone (CEO Jin Yeop Lee) announced on the 20th that it signed an MOU with the Royal Family Office led by the Prince (Ahmed Bin Faisal AL Qassimi) and a delegation at the headquarters of the Royal Family Office. The purpose of the MOU is to open branches in three Asian countries (Korea, China, and Japan) and to support Islamic banking in Korea. Through this business agreement, aiitone plans to cooperate with the establishment of a branch office in Asia (KOREA, CHINA, JAPAN), which is being promoted by the Royal Family Office. The goal is to seek various collaborations by establishing an APAC (Asia-Pacific) network. The Royal Family Office has decided to actively promote the expansion of Islamic banks in Korea and facilitate the entry of Korean companies into the Arab world. This includes attracting investments in promising domestic startups. In particular, it plans to cooperate closely with Korea in block chain fintech projects such as STO and CBDC (Central Bank Digital Currency). This agreement was concluded after active discussions with the UAE Royal Family Office by Bruce Jeong, who serves as the Principal of Middle East Investments. Bruce Jeong also serves as the Chairman of Aiitone. With the signing of this agreement, the entry of the UAE Royal Family Office into Asia has been confirmed. Officials from the Royal Family Office are planning to visit Korea next month to continue discussions. An official from the Royal Family Office stated, "Companies and investors in the UAE greatly appreciate the value and potential of the Korean market and are eager to enhance exchanges and cooperation." The official also noted, "We are pleased to observe that non-oil trade between the two countries reached 5.3 billion dollars last year, and positive interactions between the two countries are ongoing this year." He also expressed his anticipation, saying, "Through our entry into Korea, we will serve as a bridgehead to facilitate closer business development between Korea and the UAE." An official from aiitone said, “This MOU serves as an opportunity to confirm the interest of the Arab world in block chain fintech." The official also added, "We will make efforts to contribute to the development of both countries in the digital economy and technology sector by actively utilizing our technology in the field of Web 3.0, such as XR, AI, and block chain." Meanwhile, in January, the UAE government decided to invest USD 30 billion (approximately KRW 40 trillion) in Korea, demonstrating its trust in Korea. On the 6th, the 8th KOREA-UAE Joint Economic Committee was held to establish a long-lasting friendly relationship. 이동희 기자 ([email protected])investment principal royal family korean companies middle east

2023.07.25. 20:55